House price inflation is expected to slow

Dublin People 03 Oct 2015

THE trend of moderate house price growth evident in the first half of 2015 has continued into Q3 according to the latest house price survey from MyHome.ie.

The survey, compiled in association with Davy, also predicts that annual house price inflation will slow to five per cent by December.

Asking prices on new instructions – which provide the best leading indicator for actual transaction prices – actually fell by 0.1 per cent in Dublin in Q3, the first such decline in asking prices in almost three years. Nationally asking prices for new sales rose by 1.8 per cent.

According to the survey the mix adjusted asking price for new sales in Dublin is €312K while the corresponding national figure is €217K, up 1.6 per cent.

For the entire stock of properties listed for sale the national mix adjusted figure is €205K while in Dublin the corresponding figure is €286K, up 1.5 pre cent. The percentage change year on year for new sales is 4.8 per cent in Dublin and six per cent nationally.

The price of a three bed semi in Dublin remained unchanged in Q3 at €280K while the price of a four bed semi fell 1.6 per cent to €400K. The price of a two bed apartment also remained unchanged but remains up 12.5 per cent for the year.

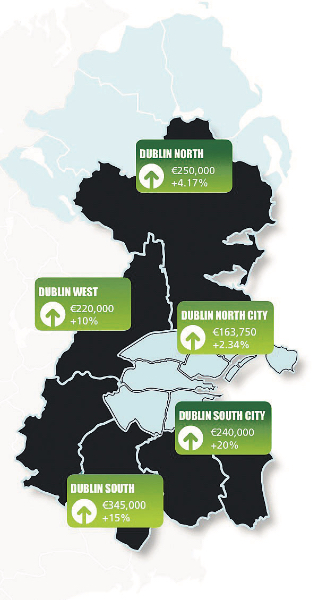

While the MyHome.ie data suggests Dublin house prices will remain relatively stable over the short term, Dublin south city was still up 20 per cent in the year to Q3 2015 while Dublin south is up 15 per cent. Dublin north prices were up 4.2 per cent on the year after a 6.4 per cent rise in Q2. Dublin north city saw asking prices up just 2.3 per cent on the year, the smallest rise in the city.

Author of the report, Conall MacCoille, Chief Economist at Davy, said he expects house price inflation to slow to five per cent by December, with a similar gain likely in 2016.

He believes stretched affordability, the Central Bank’s mortgage lending rules and an improving stock of homes available for sales are cooling price rises, particularly in Dublin.

“The house price to income ratio in Dublin – based on a median asking price of €280K for a three bed semi-detached house is now a 6.1 multiple of average incomes of €46K,” MacCoille continued.

“While the ratio varies from five in the mid-east to a low of 2.8 in the midlands, the overall figure is 5.3 which is high by international standards.

“The Central Bank’s new lending rules have prevented first time buyers in Dublin from taking out ever higher mortgages – the 20 per cent + rates of inflation of the Summer of 2014 were simply not sustainable – and this is a positive.

“The fact that the number of properties available for sale in Dublin is up 45 per cent to 5,200 compared to this time last year, has also acted as a further brake on price growth.”

However MacCoille believes a sustained decline is unlikely.

“Wage growth coupled with tax cuts in Budget 2016 will help to support house price inflation,” he explained. “Private sector earnings grew by 2.4 per cent in the first half of the year and Budget 2016 looks set to include a €1.2 to €1.5bn giveaway that could boost disposable incomes by one per cent.

“These measures and the ongoing lack of housing supply and strong rental inflation will support transaction prices and that is why we are guiding the five per cent figure.”

Angela Keegan, Managing Director of MyHome.ie, said Government action to address the lack of supply of new homes in certain areas, particularly in Dublin, is sorely needed.

“There were 6,745 housing completions in the first seven months of 2015,” she continued.

“While this is up 16 per cent from the same period of 2014 the figures are coming off a very low base and will probably struggle to exceed 13,000 this year, well short of the 25,000 required.

“The low level of new builds needs to be addressed by Government through initiatives on planning, the freeing up of development land and the removal of inappropriate levies and charges on residential developments.

“The fact rents are just 0.5 per cent below their previous peak and that cash buyers account for 50 per cent of transactions shows the urgency of addressing the supply side of the equation.”