Rents continue to rocket

Dublin People 14 May 2017

TENANTS in private rented properties across the Northside are now paying over €500 more than it would cost them for a mortgage in a similar home.

The latest quarterly Rental Price Report from Daft.ie shows the average rent for a two-bed house in Dublin 11 is now an eye-watering €1,323 while a mortgage would cost just €751. A two per cent increase in interest rates would put the mortgage up to €946, still €377 cheaper than the monthly rent. In Dublin 7, the average rent for a two-bed house is €1,505 compared to €987 for a mortgage, while in Dublin 9 it’s €1,413 to rent and €970 to buy – if you can get a mortgage.

In Dublin 15, the average cost to rent is €1,278 while a mortgage is €770.

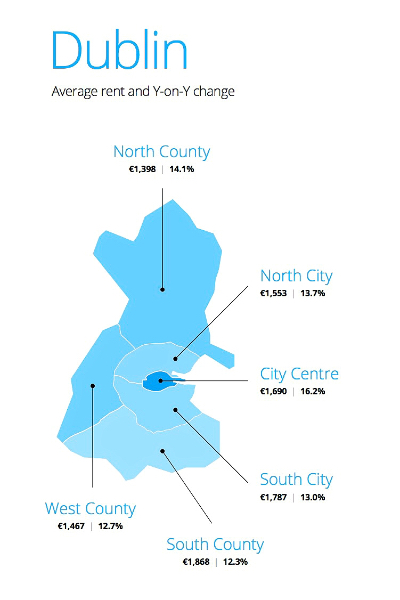

The report also shows that the average cost of renting in Dublin City Centre has rocketed by over 16 per cent to €1,690 while the North County is up by 14.1 per cent, and the increase is 13.7 per cent in the North City.

Across Dublin, rents are now 15.4 per cent above the Celtic Tiger peak in 2008 – an average of almost €225 a month.

Rents in the capital were on average 13.9 per cent higher in the first three months of 2017 than a year previously.

The average advertised rent is now €1,668, up 66 per cent from its lowest point in 2011.

There were just 1,074 properties available to rent in Dublin on May 1, the lowest figure recorded in a series of Daft.ie reports stretching back to January 2006.

Ronan Lyons, economist at Trinity College Dublin and author of the Daft report, believes the only solution to the current crisis is to increase the supply of properties.

“While the headline rate of inflation in rents has eased slightly, the market continues to exhibit signs of extreme distress,” he said.

“Rents are at a new all-time high, while the number of homes available to rent remains at the lowest levels on record.

“Regulatory measures designed to limit rent increases could only ever have a very limited effectiveness in a market with such a scarcity of supply.

“Indeed, there is evidence to suggest that increases for sitting tenants have been only half the size of increases faced by new tenants. The more appropriate solution remains to increase supply. This includes both making better use of the existing stock of housing and building substantially more, in particular more apartments.”