Property reports highlight price increases

Dublin People 13 Jan 2017

THERE was more bad news for Northside home-hunters in the first house price surveys of the year that were published at the beginning of the month.

Property website, Daft.ie, says the rate of inflation in Dublin was 5.1 per cent during 2016, close to double what it was the previous year.

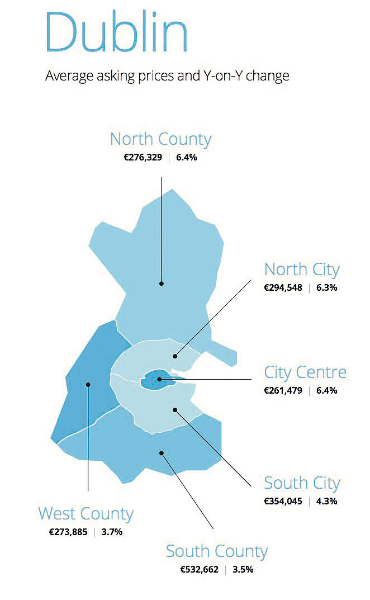

In Dublin, prices in the final three months of 2016 were five per cent higher than a year before, compared to the rise of three per cent seen a year ago. The average house price in the capital is now €322,000. The market bottom was reached in the second quarter of 2012 and prices have risen by an average of 46.2 per cent – or €101,850 – since that time.

According to Daft.ie, the average asking price in both the North City and City Centre areas is up 6.4 per cent on last year while in the North County the increase slightly lower at 6.3 per cent.

However, there was little change in average prices between September and December across most of the city although there were fewer than 2,800 properties for sale in Dublin last month, the lowest since the first half of 2014.

Close to half (48 per cent) of properties find a buyer within two months in the capital – up slightly from the same time a year ago (42 per cent).

The average transaction price is 2.8 per cent above its original list price, compared to 1.6 per cent above a year ago.

According to a separate report from MyHome.ie, 2016 asking prices in Dublin North went up eight per cent year on year but by modest 1.5 per in Dublin South.

The report warns that the combined impact of the Help-to-Buy scheme and looser lending rules means that double-digit house price inflation is a distinct possibility in 2017.

Author of the report, Conall MacCoille, Chief Economist at Davy, said robust jobs growth and the lack of supply, especially in Dublin, were already likely to deliver substantial house price gains this year.

But he said public policy on two fronts will help to further stimulate house price inflation in 2017.

“The Help-to-Buy scheme – providing a tax rebate worth five per cent of the purchase price of newly-built homes to first-time buyers – will add fuel to the fire,” he explained.

“In the short term, the measure is likely to push up house prices, helping builders’ profit margins. However there is likely to be little material impact on housing supply as land prices quickly rise.

“Secondly the Central Bank of Ireland has relaxed its lending rules so that there are no restrictions on the availability of 90 per cent loan-to-value (LTV) mortgages to first time buyers.

“While the immediate impact of the change is likely to be small, limited to Dublin and commuter belt counties which account for the bulk of transactions above the €220K threshold, the main impact may be on expectations.

“As the housing market tightens, first time buyers desperate to secure homes will be encouraged to take out the maximum 90 per cent LTV loans.”