Residential Zoned Land Tax Draft Map for Fingal now available for public to view

Padraig Conlon 03 Nov 2022

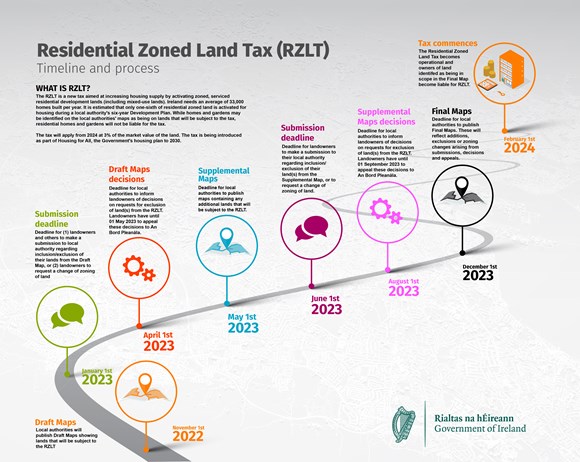

Landowners have until January 1st 2023 to check and make submissions on draft maps

Fingal County Council say they are advising members of the public they have until January 1st 2023 to check and make submissions on draft maps that show lands in Fingal that will be subject to the new Residential Zoned Land Tax.

The Residential Zoned Land Tax is a new tax aimed at increasing housing supply by activating zoned, serviced residential development lands (including mixed-use lands) for housing. Greenfield and brownfield land which is identified and is zoned for housing (include land zoned mixed-use) will be subject to tax from 2024.

The tax is a commitment under Housing for All, the Government’s housing plan to 2030.

The Draft Map is now available to view on Fingal County Council’s website and in its public offices.

The Draft Map shows lands that will be subject to the new Residential Zoned Land Tax.

Landowners and third parties have until January 1st 2023 to make a submission to Fingal County Council about whether or not land on the map meets the criteria for being subject to the tax.

They can:

- Make a suggested correction to the Draft Residential Zoned Land Tax Map if they feel that the land included on the map does not meet the criteria, or they disagree with the date on which the maps states the land met the criteria

- Request a change of zoning of their land so that it is not subject to the tax

- Identify other land that should be subject to the tax

Homeowners will not have to pay the Residential Zoned Land Tax if they own a residential property which appears on the local authorities’ Residential Zoned Land Tax Maps, but which is subject to the Local Property Tax (LPT). If a homeowner owns such a residential property, and the land/gardens/yards attached to it are greater than 0.4047 hectares, they will have to register for the Residential Zoned Land Tax with the Revenue Commissioners, but they will not be liable to pay the tax. It will be possible to register for the tax from late 2023 onwards.

Urging people to check the Draft Map, Director of Planning and Strategic Infrastructure Matthew McAleese from Fingal County Council said:

“I would strongly urge members of the public to assess the Draft Map published on the Fingal County Council Website (https://www.fingal.ie/ResidentialZonedLandTax) and, if required, make a submission before January 1st 2023 (see conslt.fingal.ie).

Fingal requires increased housing supply to meet our housing needs and the new tax aims to incentivise landowners to develop housing on serviced lands zoned for housing, both land with existing planning permission and land without.”

The Residential Zoned Land Tax is an annual tax, which will be first due in 2024 in respect of lands included on the final maps to be published by local authorities on 1 December 2023. The Residential Zoned Land Tax will apply annually at a rate of 3% of the market value of the land. The tax will be administered on a self-assessed basis.

A homeowner may have to pay the tax if they own a residential property that appears on the local authorities’ Residential Zoned Land Tax maps that is not subject to the LPT.

Fingal County Council’s Draft Map can be viewed on https://www.fingal.ie/news/residential-zoned-land-tax or at Fingal County Council Offices: County Hall, Main Street, Swords, Co. Dublin, K67X8Y2 and Civic Offices, Grove Road, Blanchardstown, Dublin 15, during normal office hours, Monday to Thursday 9.00am-5.00pm and Friday 9.00am to 4.30pm.

More information on the measure can also be found at http://www.gov.ie/rzlt