COMMENT: I’m getting a Celtic Tiger déjà vu feeling

Dublin People 13 Apr 2018

IRELAND’s housing crisis is probably best exemplified by people having to sleep in their cars: at one end we have those who are homeless; at the other there are the anxious first-time buyers queuing to put down a deposit on a modest property in a Dublin suburb.

Both sides are united by the common purpose of wanting to put a roof over their heads, albeit in very different circumstances.

It’s undoubtedly a stressful situation for both sets of demographics. Some of those putting their heads down for the night in the back of their vehicle may have become homeless for a multitude of reasons.

Perhaps they have lost their job and then their home; others may be in the midst of a complicated relationship breakdown; some are possibly victims of a chaotic lifestyle involving drug or alcohol abuse. It’s nearly impossible to tell – every car seat has its own story.

Those queuing to stake their claim on a new property by sleeping rough in their cars or languishing for days on deckchairs in the freezing cold also attract our sympathy, but perhaps to a lesser degree.

We might consider them to be the lucky ones, fortunate enough to be able to secure a deposit that is prohibitively out of reach for many first-time buyers. However, the reality is that we don’t known their full story either.

What sacrifices did they have to make in their personal lives to save that type of money? What are the financial implications for the many generous parents who have loaned their life savings to get their children on the property ladder?

Last week we learned that the dream of owning a family home is now beyond the reach of couples with a joint income of €92,000 due to spiralling prices. The main difference between now and the boom is that there are tighter restrictions on lending these days, even if property prices are creeping back to their 2007 peak levels.

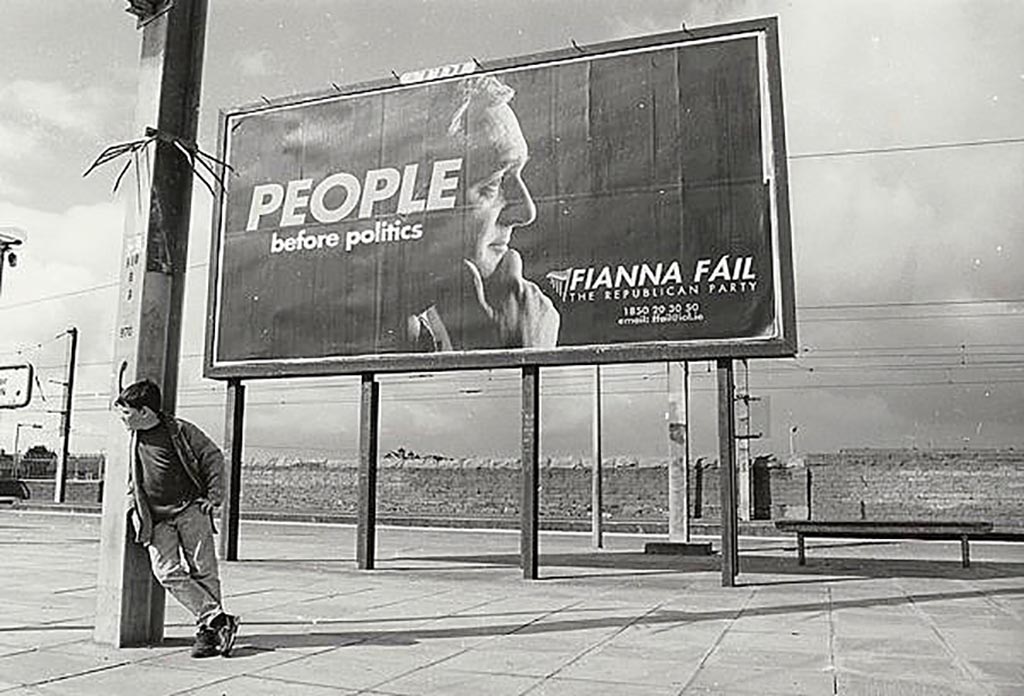

To reinforce this sense of Celtic Tiger déjà vu, we now have one of the main political players from that era hinting at a run for the presidency.

Bertie Ahern has been blamed by many of his critics, with some justification, for helping to create the last property bubble. But the current escalating housing crisis goes to show that his successors have been more than capable of doing it equally well in his absence.